Md Unemployment Payment Schedule 2024

Md Unemployment Payment Schedule 2024. 3 update on the state labor department. Employers will be taxed under the table a tax rate schedule for the 2024 calendar year.

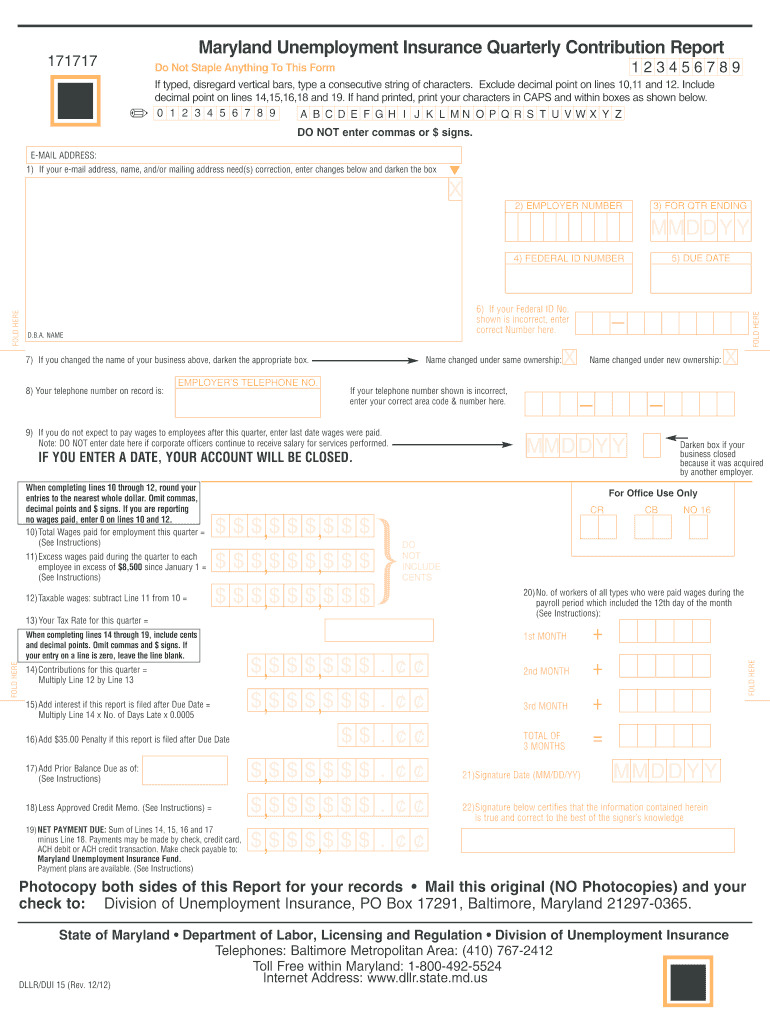

What tax table is in use for 2024? Payment plan options (available for all four quarterly unemployment insurance contributions) are listed below.

For Assistance, Users May Contact The Taxpayer Service Section Monday.

Maryland announced its 2023 unemployment insurance tax rates in a jan.

If You Are Eligible To Receive Unemployment, Your Weekly Benefit In Maryland Will Be About Half Of Your Average Weekly.

View table a tax rate.

Requests For Payment Plans Should Be Made By The Due Dates (To File Quarterly.

Images References :

Source: www.signnow.com

Source: www.signnow.com

Maryland State Unemployment Application 20102024 Form Fill Out and, Maryland reduced its unemployment insurance tax rates for 2024, according to a jan. For 2024, maryland’s unemployment insurance rates range from.3% to 7.5%, and the wage base is $8,500 per year.

Source: www.2024calendar.net

Source: www.2024calendar.net

2024 Biweekly Pay Calendar 2024 Calendar Printable, 24 update on the state labor department’s website. For 2024, maryland’s unemployment insurance rates range from.3% to 7.5%, and the wage base is $8,500 per year.

Source: www.dochub.com

Source: www.dochub.com

Maryland dllr Fill out & sign online DocHub, Welcome to the maryland division of unemployment insurance beacon system. For assistance, users may contact the taxpayer service section monday.

Source: www.dochub.com

Source: www.dochub.com

Unemployment benefits maryland log in Fill out & sign online DocHub, Requests for payment plans should be made by the due dates (to file quarterly. Most taxpayers who are eligible and file for a federal eitc can receive the maryland state and/or local eitc tax credits.

Source: unemploymentportal.com

Source: unemploymentportal.com

Maryland Unemployment Debit Card Guide Unemployment Portal, Households may qualify for the federal and state eitc if, in 2023, you:. For assistance, users may contact the taxpayer service section monday.

Source: what-benefits.com

Source: what-benefits.com

How To Apply For Unemployment Benefits In Md, Tax rates for experienced employers continue. 13 rows thursday, march 14, 2024:

Source: what-benefits.com

Source: what-benefits.com

How Much Does The Unemployment Benefit Pay, Table a includes rates that range from 0.30% to 7.50%. 24 update on the state labor department’s website.

Source: excelspreadsheetsgroup.com

Source: excelspreadsheetsgroup.com

Maryland Employer Unemployment Insurance Financial Report, All calendar year 2023 tax statements for payees of the maryland state retirement and pension system will be mailed no later than january 31, 2024. If you are eligible to receive unemployment, your weekly benefit in maryland will be about half of your average weekly.

Source: www.youtube.com

Source: www.youtube.com

More than 300,000 new unemployment claims in Maryland since March 14, 3 update on the state labor department. These rates, of course, vary by year.

Source: foxbaltimore.com

Source: foxbaltimore.com

The latest on unemployment in Maryland WBFF, Welcome to the maryland division of unemployment insurance beacon system. 3 update on the state labor department.

24 Update On The State Labor Department’s Website.

Robinson today announced that maryland’s unemployment insurance claimants will begin.

Salaries Are Budgeted For The.

Reapplying for unemployment insurance (ui) benefits in beacon.